What is Commodity Trading?

Commodities, such as metals, energy, and agricultural products, are essential raw materials used in various industries worldwide. In CFD trading, commodities are traded as contracts for difference (CFDs), enabling traders to participate in the price movements of commodities using financial instruments.

Benefits of Trading Commodity CFDs

Commodities provide diversification by moving independently from stocks and bonds, making them valuable for hedging against inflation. They mirror global economic conditions, with seasonal price trends offering potential trading opportunities. The inherent volatility of commodity markets creates chances for traders to capitalize on price fluctuations.

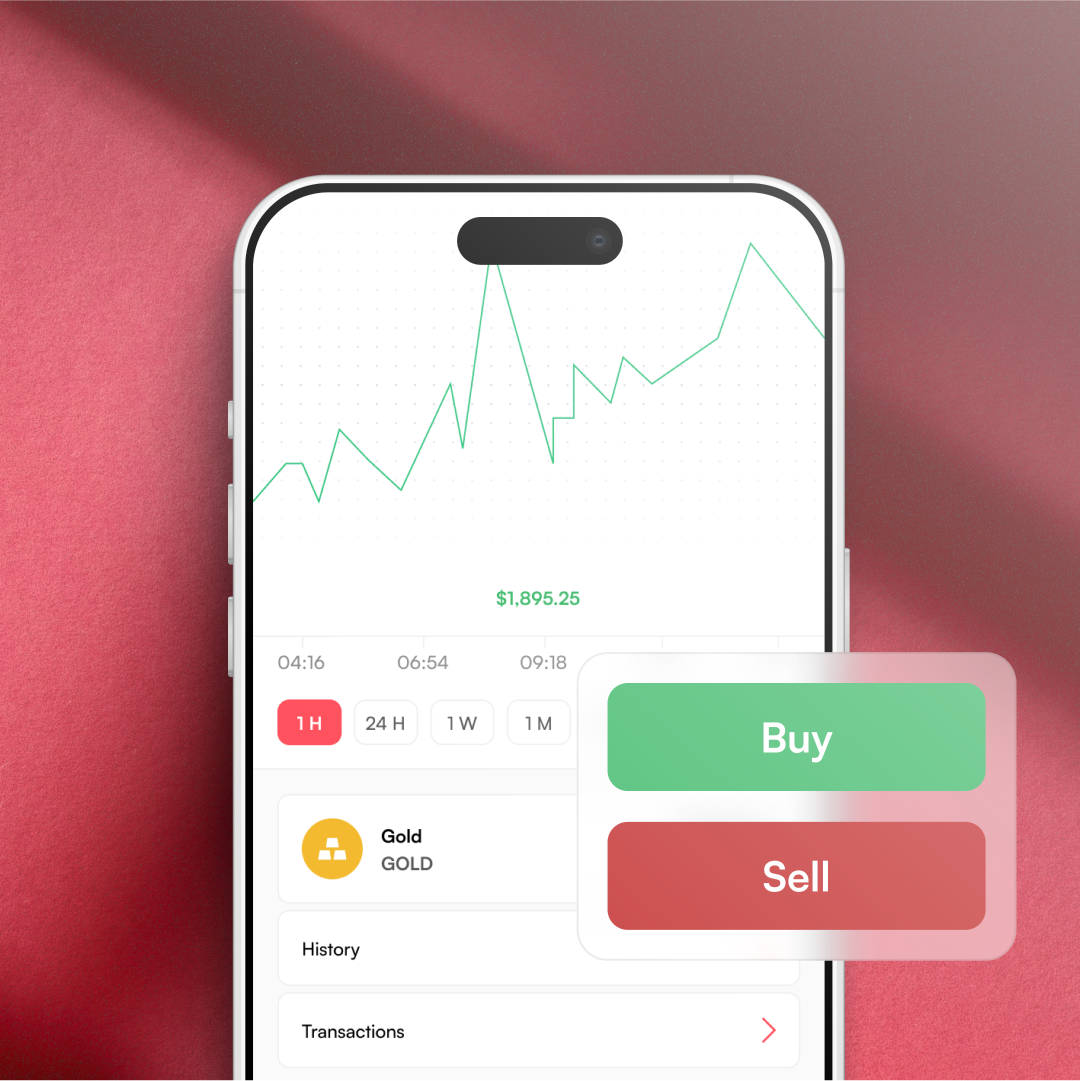

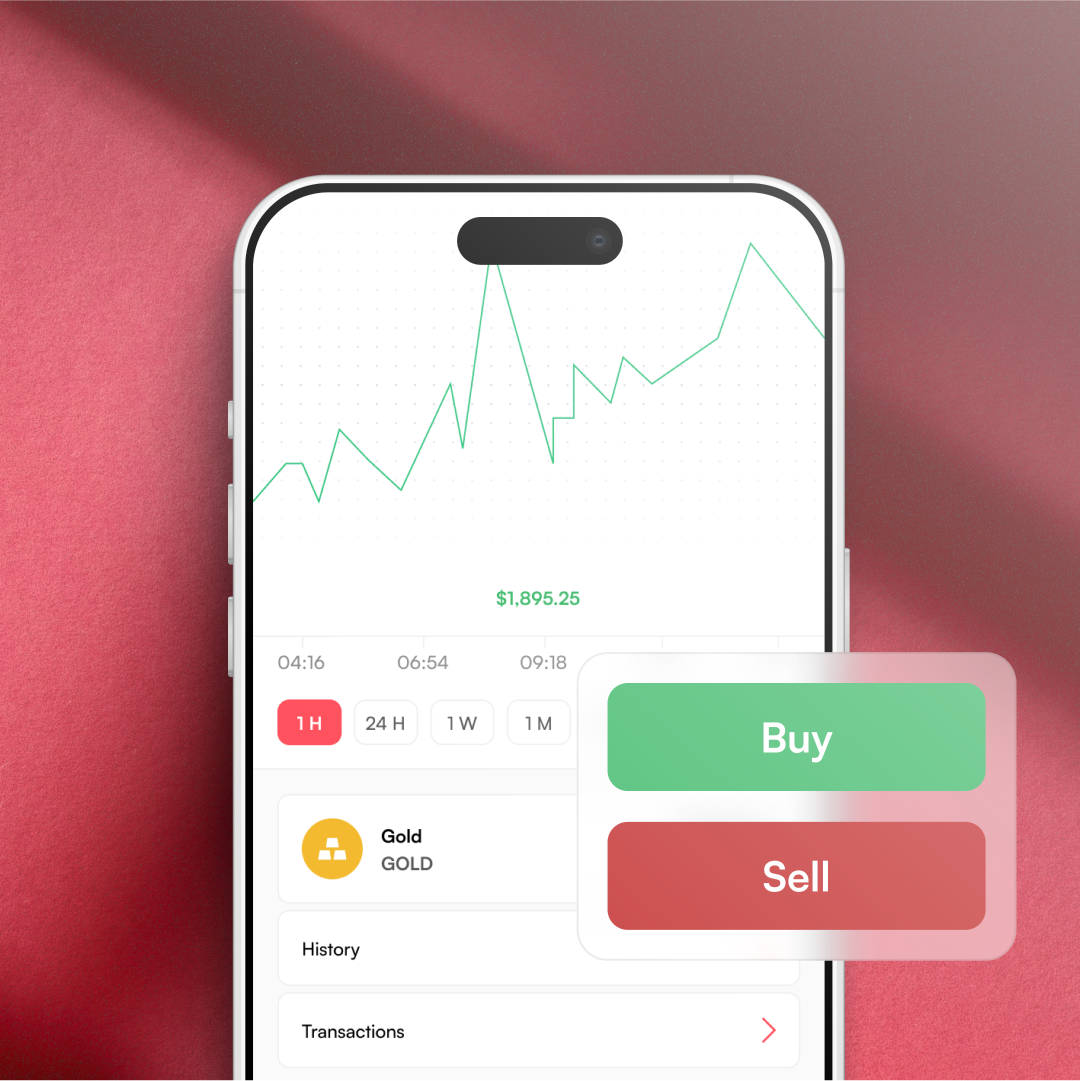

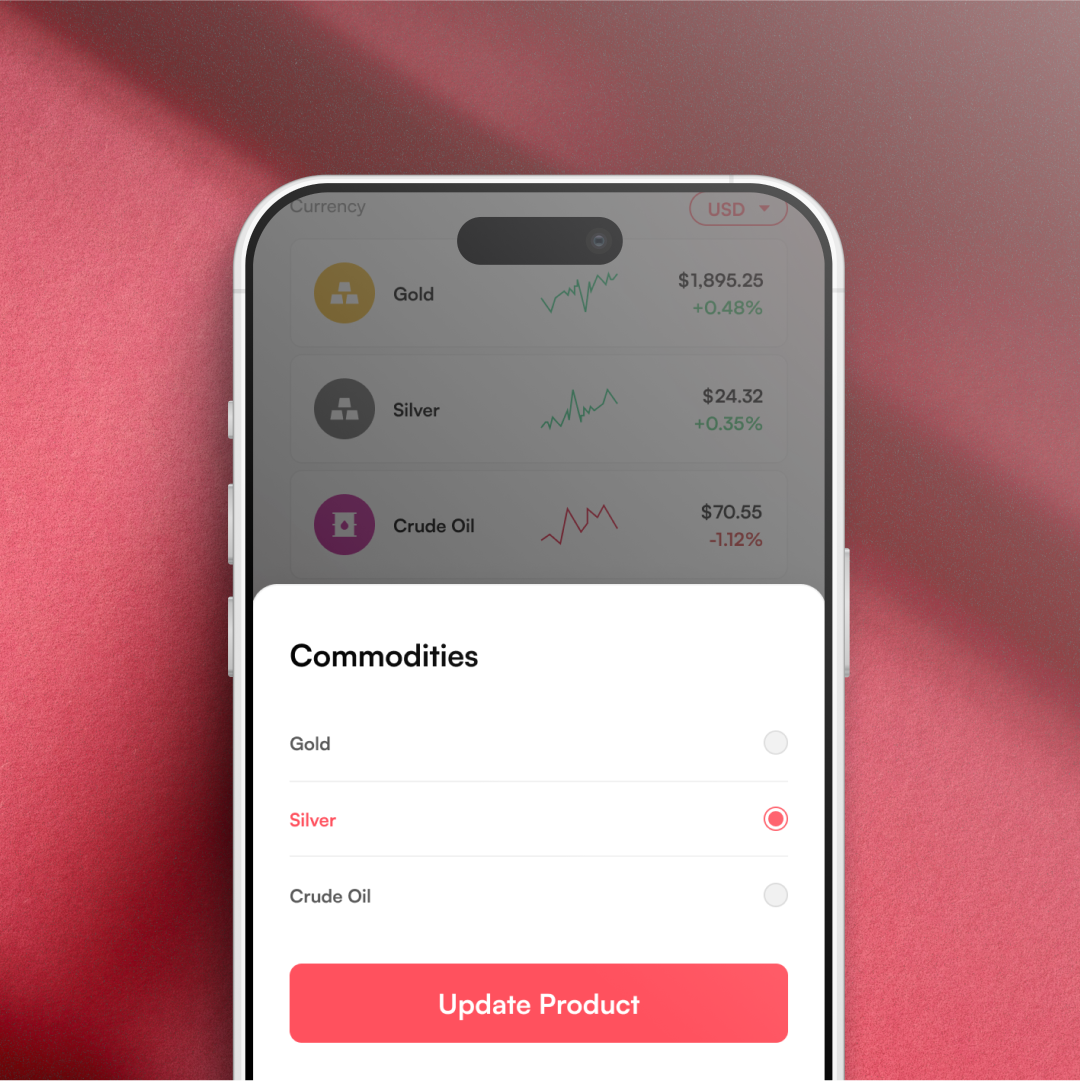

How to Trade Commodities with Mirrox

Start your commodity trading journey with Mirrox in three simple steps. First, choose your commodity from Mirrox's extensive range, considering market trends and your objectives. Next, develop a trading strategy with defined entry and exit points, risk management, and profit targets. Finally, execute your trade on the Mirrox platform, set your position and parameters, and monitor your trade, adjusting as needed.

Commodities Offered by Mirrox

| Symbols | Description | Leverage (Up to) | |

| BRENT (Crude Oil Brent Cash) | Brent crude oil is a benchmark for oil prices worldwide, representing oil produced in the North Sea. | 1:200 | |

| USOIL.c (West Texas Intermediate Crude Oil Cash) | Ang WTI crude oil ay kilala para sa mataas na kalidad nito at isa itong mahalagang benchmark para sa mga presyo ng langis sa Estados Unidos. | 1:200 | |

| COCOA.f (Cocoa US Futures) | Cocoa futures track the price of cocoa beans, which are used to produce chocolate and other confectionery products. | 1:200 | |

| COFFEE.f (Coffee US Futures) | Coffee futures represent the price of Arabica coffee beans, which are renowned for their rich flavor and aroma. | 1:200 | |

| USCOP.f (Copper Futures) | Copper futures are widely traded and are considered an indicator of economic activity due to copper's extensive use in construction and manufacturing. | 1:200 | |

| COTTON.f (Cotton US Futures) | Cotton futures track the price of raw cotton, which is an important raw material for the textile industry. | 1:200 | |

| NGAS.f (NGAS Futures) | Natural gas futures represent the price of natural gas, a clean and efficient energy source used for heating and electricity generation. | 1:200 | |

| SUGAR.f (Sugar US Futures) | Sugar futures track the price of raw sugar, used in food and beverage production worldwide. | 1:200 | |

| CORN.f (Corn Futures) | Corn futures represent the price of corn, a staple crop used for food, animal feed, and ethanol production. | 1:200 | |

| SBEAN.f (Soybean Futures) | Soybean futures track the price of soybeans, which are used in various food products, animal feed, and biodiesel production. | 1:200 | |

| WHEAT.f (Wheat Futures) | Wheat futures represent the price of wheat, a key staple food crop consumed by billions of people worldwide. | 1:200 | |

| UKBRNT.f (Crude Oil Brent Futures) | Similar to Brent crude oil cash, Brent futures represent oil produced in the North Sea and serve as a benchmark for global oil prices. | 1:200 | |

| USOIL.f (West Texas Intermediate Crude Oil Futures) | WTI crude oil futures track the price of high-quality oil produced in the United States, providing insight into the global oil market. | 1:200 |

Learn CFD Commodity Trading with Mirrox

Knowledge is power in trading, especially with commodities. Our Education Center helps you reach your trading goals by providing market insights to navigate fluctuations confidently, risk management strategies to protect your investments, technical analysis tools for precise market timing, and fundamental analysis to anticipate market shifts and identify potential trends.

Important information:

Thank you for visiting Mirrox

Please note that Mirrox does not accept traders from your country